October 12th, 2023 — Powerhouse Ventures has followed a fascinating through-line this year, taking the team up and down the critical mineral supply chain. We began by exploring second- and end-of-life battery startups, finding our way to mineral traceability, and ultimately arriving upstream in the mining innovation space — the headwaters of the clean economy transition.

During this time, the team has gained some clarity on the challenges and opportunities that face rare earth mineral miners, the organizations that supply the lithium, copper, cobalt, and other “transition minerals” destined for our future EVs, transmission lines, batteries, solar panels, and wind turbines. Our conclusion? The climate tech ecosystem is operating in a pivotal moment in time as the climate tech gold rush hits already strained mining operations across the world.

That's what we aim to cover in this post: the growing supply and demand gap between mines and their customers, key market forces at play, and the innovation themes throughout. For this piece, we focus on the opportunities and learning gleaned from the prospecting and exploration phase of the mining value chain, shown below.

Beating the Status Quo: Just Mining for a Just Transition

Before we get started, as a climate-oriented community, I want to acknowledge a critical issue here that will not be addressed in detail in this post. It should be our collective goal to address the current and historical labor, human rights, environmental, and local community impacts mining has in context to our industry’s desire to decarbonize. While mines are a foundational input to climate success, it's imperative to rethink the status quo, urging investors, mines, and regulators to operate ethically and sustainably, while giving power and resources to local communities, treating them as robust partners, stakeholders — even shareholders — in projects that impact them.

If interested in learning more about the most pressing social and environmental challenges and opportunities in the mining space, please click through the resources here.

Transition Minerals Tracker shows the human rights practices of 93 companies and their 172 mining operations that produce the minerals vital to the clean economy.

Natural Resource Governance Institute supports informed, inclusive decision-making about natural resources and the energy transition.

Free, Prior and Informed Consent (FPIC) for just mining development with Indigenous communities.

The $1.7T Transition Mineral Mining Opportunity

For mines today, finding, permitting, and developing new greenfield (undeveloped) mine sites and extracting as much value from already developed advanced exploration (existing) sites is increasingly difficult to accomplish. Demand for high-quality ore is growing, while output is constrained. To be specific, the mining and metals industry will need to invest $1.7T over the next 15 years in innovation and process improvements like direct lithium extraction, enhanced metal recovery, and machine learning (ML) and artificial intelligence (AI) to supply the copper, cobalt, nickel, and other critical metals needed for a successful transition.

At the same time, mines have historically been categorized as a slow-moving and low-tech customer set, taking a conservative approach to investing in and deploying new innovations.

However, this dynamic is shifting.

Mine-site optimization has been a pain point for the mining industry for decades and the emergence of new tech like ML and AI, as well as access to new talent sets like data engineers, who have the skills to accurately make sense of large drill and geological data, has only recently been available to and applied to mining resource optimization and forecasting use cases.

Key Mining Megatrends and Market Pressure Points

Today, suppliers for transition minerals are starting to feel both historical and new market pressures coming at them from all sides. The following is a short list of key market forces influencing the sector today.

Global Ore Demand Pressure: On the demand side, the production of transition minerals such as graphite, lithium, and cobalt, is projected to increase by nearly 500% by 2050. Demand for the critical minerals needed to decarbonize the U.S.’s economy specifically is expected to increase by 400-600% over the next two decades.

Investor Pressure for Increased Sustainability and Impact: Access to capital is key for mines, and investors are increasingly holding mining companies to higher standards of accountability, particularly against more robust ESG factors. Issues like waste management, water use, human rights assurances, child labor infractions, provenance from conflict-affected countries, political insecurity, poor community relations, and poor occupational health are key considerations for investors.

Mine Output Constraints: On the supply side, mines are a bottleneck due to a number of mine-side constraints. New mines face long, complicated development lead times, sometimes resulting in a ten-year waiting game until production starts. Obtaining permits for existing and new projects requires growing ESG considerations—a necessary addition in our opinion. Finally, new extraction technologies are only just starting to be integrated, but are not yet mature.

Declining Mine Productivity: Historically, more than 99% of exploration projects fail to become mines. The industry today spends three times more to make 60% fewer discoveries compared to 30 years ago, an ugly trend in the face of already thin global project pipelines.

Declining Ore Quality: Mineral quality has continued to decline across commodities as discoveries of new high-quality deposits are extremely limited. For example, the average copper ore grade in Chile has decreased by 30% over the last 15 years. Since deposits in major mines are being depleted, developments are moving more toward the fringes of exploited deposits.

Geopolitical & Policy Uncertainty: The mining industry is facing risks emerging from political instability on multiple global fronts. Issues range from changing tax laws, delays in project approvals, and countries toying with the idea to nationalize mineral production, potentially diverting growth and investment away from private-sector producers. These developments stir uncertainty and make investments in certain regions harder for investors and mines.

Innovation Interest vs. Investment Lag: While large mines have shown interest in investing in emerging technologies like direct lithium extraction, enhanced metal recovery from waste streams, or experimenting with ML, IoT, AI, or automation, historically, there has been little real innovation investment in critical minerals. In fact, the mining and metals industry will need to invest $1.7 trillion in new technology and current process improvements over the next 15 years to supply enough of the critical metals to climate tech manufacturers.

Innovation Affordability: While access to new AI/ML tech and talent is an accelerator for mine innovation, it can be out of reach of most of the market that is made up of smaller, mid-market, or junior miners. This mid-to-long tail of mining companies often cannot afford expensive, bespoke tools, or large in-house teams to manage and maintain new technologies or systems.

Physical Climate Risk Pressure on Mines: Mining sites and supply chains are also susceptible to physical climate risks that threaten operational efficiency, production, and safety and increase costs and on-site emissions. Today, water stress affects up to 50% of critical metal production such as copper, iron ore, and zinc. In some cases, climate risks like drought will affect 100% of sites for resources such as copper by 2040.

Mining Prospecting & Exploration Market Map

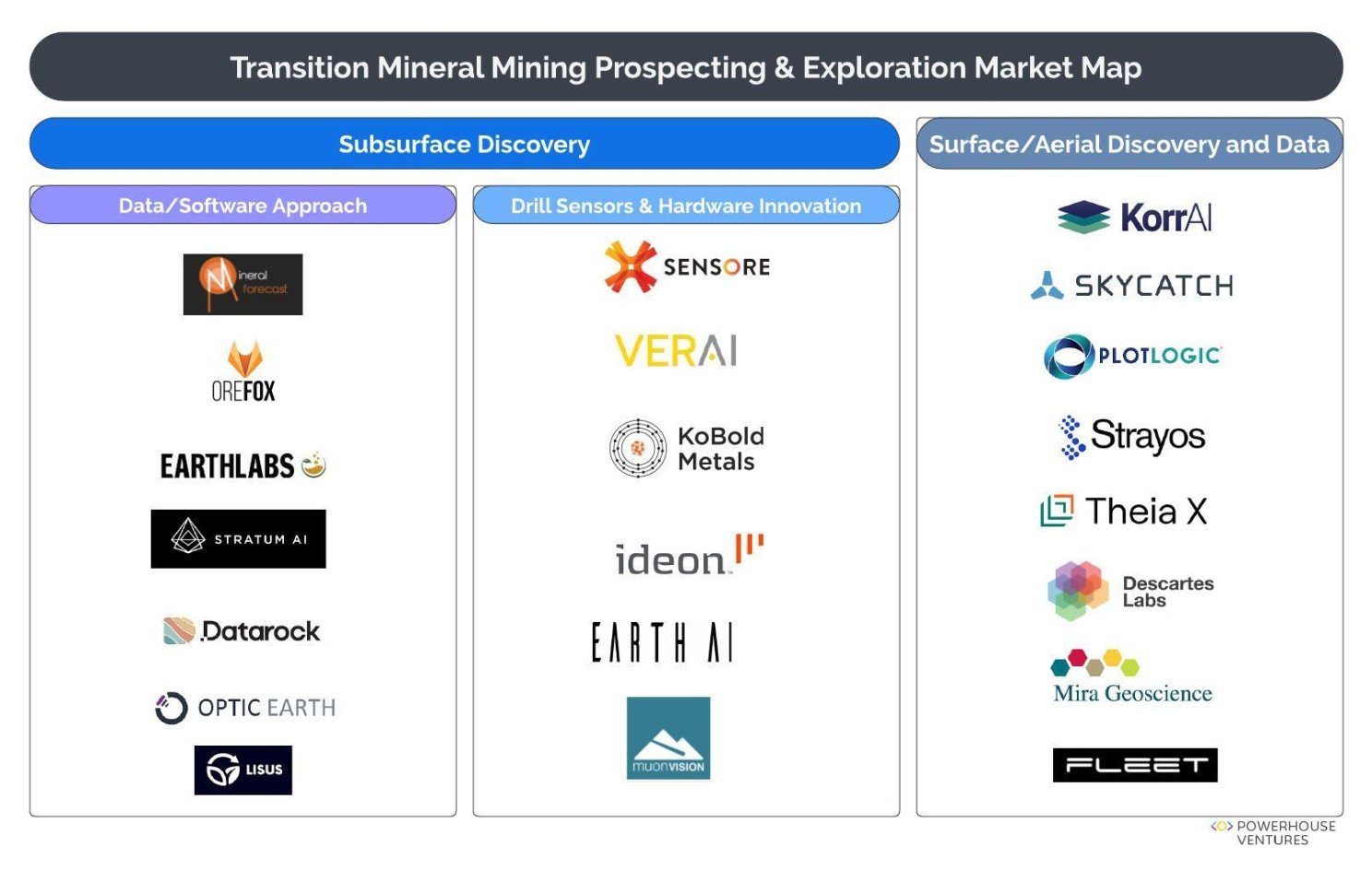

Over the past five years, several startups have entered the mining innovation space. The market map below focuses on the emerging players in prospecting and exploration, folks working on scoping new mine sites or increasing production and production efficiency at existing mines. This is not a comprehensive list.

Powerhouse Ventures

Powerhouse Ventures’ Take

As the energy transition picks up momentum there is an emerging opportunity for entrepreneurs, investors, and regulators to help close the gap between critical mineral supply and demand. This overview just scratches the surface.

On one hand, mines are starting to feel pressure from all sides, being asked to do more with less, managing exploration and resource output more efficiently while operating more ethically and sustainably. On the other hand, end buyers at the country, corporate, and supply chain level are scrambling to execute on emission reduction goals, providing a unique moment in time for emerging talent and technology to step into the spotlight and address the $1.7T investment gap.

At this point in time, Powerhouse Ventures remains interested in and excited about founding teams in the mining space leveraging data, AI, ML, and other scalable and easily deployable technologies for more intelligent and efficient mining of transition minerals. Given the incoming demand wave of critical minerals, mines will need more data, tools, and partners to build resilient, ethical, and environmentally sustainable mining systems.

If you have also been looking closely at this space, or are a founder tackling mining sustainability and efficiency, we would love to hear from you!

Special thanks to Shaandiin Cedar.

To read more about our work at Powerhouse and Powerhouse Ventures, visit our Insights page.

All text and images are licensed by Powerhouse under Creative Commons license CC BY 4.0. You may reuse images and text by permission and with attribution.